free cash flow yield plus growth

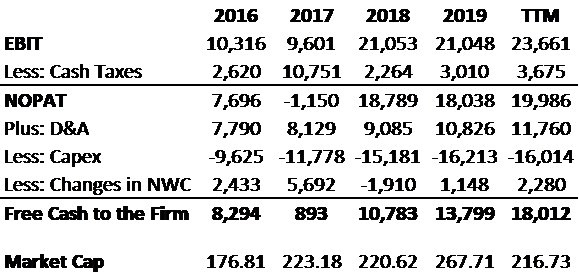

We could also look at the free cash flow yield in relation to its trailing-twelve-month numbers or TTM to get the latest yield. Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns.

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

It works similarly to earnings yield.

. Danaher is a low-yield stock with tremendous free cash flow growth potential thanks to its business model low debt load and efficient MA history. Once you calculate the Terminal Value then find the present value of the Terminal Value. Free Cash Flow Yield 16932 Billion 21516 Billion Free Cash Flow Yield 786.

Divided by the stock price so thats your free cash flow yield plus the annual rate of growth in that cash flow while still making such payments. Apples AAPL 12543 free cash flow yield isnt one of the highest amongst the 10 stocks covered here but. Its less than its highs but this doesnt mean the markets expensive.

But over the past four quarters its free cash flow surged to 292 billion. In our model we have assumed this growth rate to be 3. Pfizers dividend yields an above-average 29 at current share prices and the company hiked its quarterly payouts.

Going forward there is no way to be sure that free cash flow yield will continue to provide the best returns. In fact there have been market cycles where companies with high free cash flow yields have underperformed. When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model.

Free cash flow yield. As of March 11 the markets free cash flow yield is about 54. The ratio is calculated by taking.

Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio. Free Cash Flow Yield Plus Growth Alphabet annual free cash flow for 2019 was 30972b a 3565 increase from 2018. We calculate the most recent quarters free cash flow and multiply by four to provide an annualized free cash flow number that we feel best reflects the companys most recent performance without penalizing the company for prior poor.

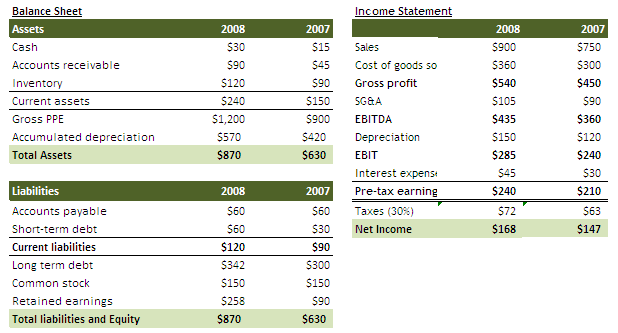

The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022 x 1growth Keg The growth rate is the perpetuity growth of Free Cash Flow to Equity. The number that really matters isnt free cash flow. We can also compare the FCF Yields to bond yields.

From 1978 to 2018 the average FCF yield of the SP 500 was 485. Now we are providing a list of all the stocks that currently have a free cash flow yield of 25 or more. Its the amount of cash flow available to buy back stock pay dividends acquire other businesses etc.

You should not depend on just one measure of course. Of those using discounted free cash flow models FCFF models are. Dont let this fool you though.

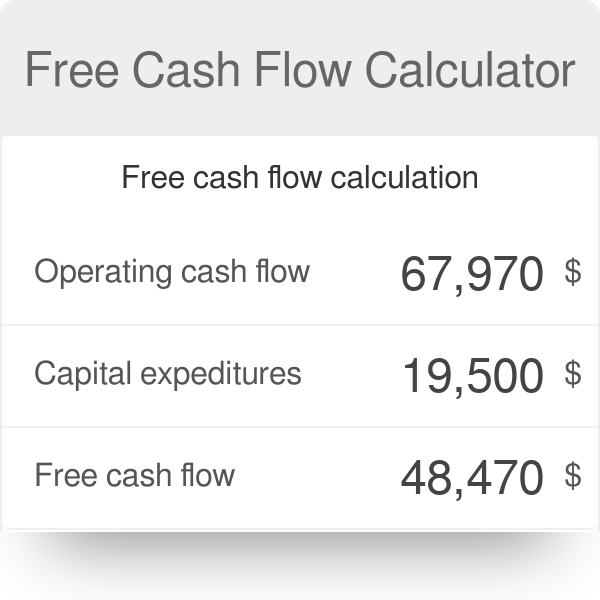

Heres the fun part. Free cash flow yield is really just the companys free cash flow divided by its market value. Free cash flow is a desirable characteristic in stocks particularly thosewith above-average growth rates.

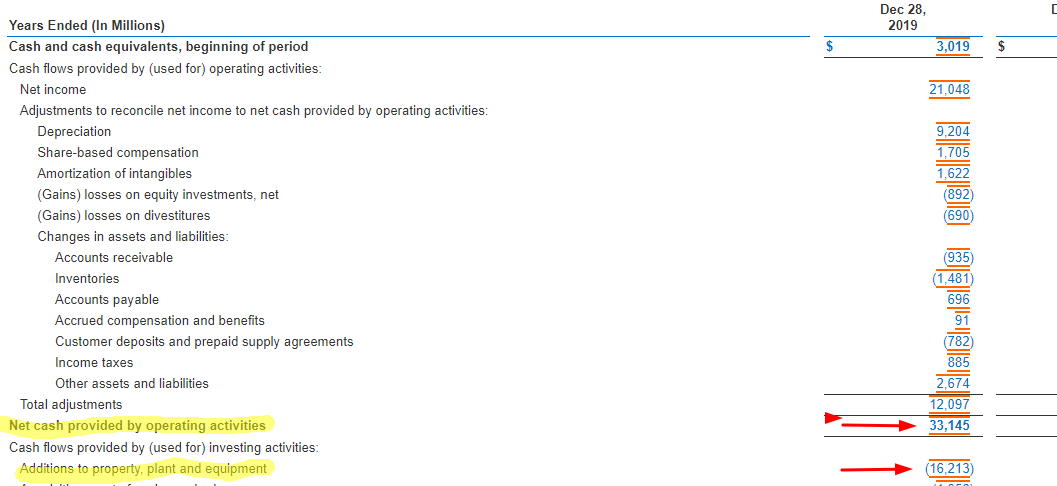

Free cash flow yield free cash to the firm market cap. Investors who wish to employ the best fundamental. For the growth part of the Forward Rate of Return calculation GuruFocus uses the 5-year average growth rate of EBITDA per share as the growth rate and the growth rate is always capped at 20.

Assuming an inflation rate of 25 the forward rate of return on an investment in the SP 500 is about 65 today 25 free cash flow yield plus 15 real growth plus 25 inflation. This can be substantially different than EPS since it is real money as opposed to earnings which can be somewhat theoretical. Free cash flow score fcf score is calculated as follows.

We can use the FCF Yield to rank all stocks on an apples-to-apples basis. We call them Cash Flow Kings. Free cash flow yield free cash flowenterprise value offered the investor the highest return.

While Danahers dividend growth is expected to. Now to calculate the free cash flow yield we divide the free cash flow by the market cap of the company. A company with a steady free cash flow yield can consider dividend payments share buybacks inorganic and organic growth opportunities Organic Growth Opportunities Organic growth is the rate of growth that a company achieves by increasing sales revenue by increasing volume of products sold or by achieving greater operational efficiency leading to a reduction in the cost.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Hopefully this free YouTube video has helped shed some light on the various types of cash flow how to calculate them and what they mean. Free Cash Flow Yield Stocks price equals market cap in the world of stocks many growth companies generate negative fcf yields.

The valuations of the years 2007 through 2011 were the exception not the norm. The ratio of Free Cash Flow to a companys enterprise value FCF Enterprise Value. The Operating Cash Flow Growth Rate aka Cash Flow From Operations growth rate is the long term rate of growth of operating cash the money that is actually coming into the bank from business operations.

FCF yields PE multiples. To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital expenditures from all cash flow. Investors who wish to employ the best fundamental indicator should add free cash flow yield to their repertoire of financial measures.

If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. Thats 2 the same as the bond. It is a sign of financial flexibility andan associated ability to perpetuate growth.

Free cash flow yield is a free cash flow per share divided by current market price per share. FCF Yield is the answer. To make sure you have a thorough understanding of each type please read CFIs Cash Flow Comparision Guide The Ultimate Cash Flow Guide EBITDA CF FCF FCFE FCFF This is the ultimate Cash Flow Guide to understand the.

Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio.

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Calculator Free Cash Flow

Free Cash Flow Calculator Free Cash Flow

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Vs Levered Fcf Yield Formula And Excel Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

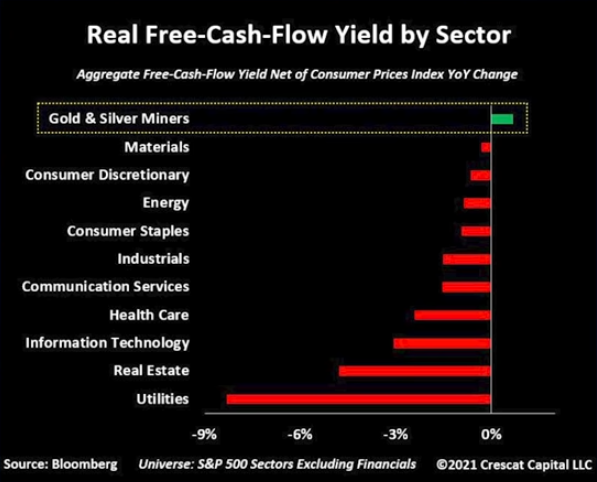

Top Sector Etf For 2021 Free Cash Flow Ring Nasdaq Ring Seeking Alpha

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)